Class 12 Business Studies Financial Management – Get here the Notes for Class 12 Business Studies Financial Management. Candidates who are ambitious to qualify the Class 12 with good score can check this article for Notes. This is possible only when you have the best CBSE Class 12 Business Studies study material and a smart preparation plan. To assist you with that, we are here with notes. Hope these notes will helps you understand the important topics and remember the key points for exam point of view. Below we provided the Notes of Class 12 Business Studies for topic Financial Management

- Class: 12th

- Subject: Business Studies

- Topic: Financial Management

- Resource: Notes

CBSE Notes Class 12 Business Studies Financial Management

Candidates who are pursuing in Class 12 are advised to revise the notes from this post. With the help of Notes, candidates can plan their Strategy for particular weaker section of the subject and study hard. So, go ahead and check the Important Notes for Class 12 Business Studies Financial Management.

Points to Remember

1. Business Finance Money required for carrying out business activities is called Business Finance.

2. Financial Management It refers to efficient acquisition of finance, efficient utilisation of finance and efficient distributing and disposal of surplus for smooth working of company.

According to Howard and Upton, “Financial management involves the application of general management principles to a particular financial operation.

3. Role of Financial Management

- Size and composition of fixed assets

- Amount and composition of current assets

- The amount of long term and short financing

- Fixing debt equity ratio in capital

- All items in Profit and Loss account

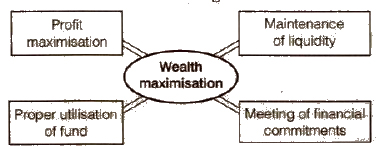

5. Objectives of Financial Management

6. Financial Decisions

The financial functions relate to three major decisions which very finance manager has to take

- Investment decision

- Financing decision

- Dividend decision

7. Investment Decision (Capital Budgeting Decision)

This decision relates to careful selection of assets in which funds will be invested by the firms.

Factors affecting investment/capital budgeting decisions are

- Cash flow of the project

- Return on investment

- Risk involved

- Investment criteria

8. Financing Decision This relates to composition of various securities in the capital structure of the company. Mainly sources of finance can be divided into two categories

- Owners fund

- Borrowed fund

Factors affecting financing decisions are

- Cost

- Risk

- Cash flow position

- Control consideration

- Floatation cost

- Fixed operating cost

- State of capital market

9. Dividend Decision This relates earned. The major alternatives are to distribution of to retain the earnings profit or to distribute to the shareholders.

Factors affecting dividend decisions are

- Earning

- Stability of earning

- Cash flow position

- Growth opportunities

- Stability of dividend

- Preference of shareholders

- Taxation policy

- Access to capital market consideration

- Legal restrictions

- Contractual constraints

- Stock market reaction

10. Financial Planning It means deciding in advance how much to spend, on what to spend according to the funds at your disposal.

11. Objectives of Financial Planning

- To ensure availability of funds whenever these are required.

- To see that firm does not raise resources unnecessarily.

12. Importance of Financial Planning

- It facilitates collection of optimum funds.

- It helps in fixing the most appropriate capital structure.

- Helps in investing finance in right projects.

- Helps in operational activities.

- Base for financial control.

- Helps in proper utilisation of finance.

- Helps in avoiding business shocks and surprises.

- Link between investment and financing decisions.

- Helps in co-ordination.

- It links present with future.

13. Capital Structure Capital structure means the proportion of dept and equity used for financing the operations of business.

Capital Structure = (Debt/Equity)

14. Financial Leverage It refers to proportion of debt in the overall capital

Financial Leverage = (D/E)

Where, D = Debt, E = Equity

15. Factors Determining the Capital Structure

- Cash flow position

- Interest Coverage Ratio (lCR) = (EBIT/Interest)

- Debt Service Coverage Ratio (DSCR)

- Return on investment

- Cost of debt

- Tax rate

- Cost of equity

- Floatation cost

- Risk consideration

- Flexibility

- Control

- Regulatory framework

- Stock market condition

- Capital structure of other companies

16. Fixed Capital Fixed Capital involves allocation of firm’s capital to long term assets or projects.

17. Importance or Scope of Capital Budgeting Decision

- Long term growth

- Large amount of funds involved

- Risk involved

- Irreversible decision

18. Factors Affecting Requirement of Fixed Capital

- Nature of business

- Scale of operation

- Technique of production

- Technology upgradation

- Growth prospects

- Diversification

- Availability of finance and leasing facility

- Level of collaboration/joint ventures

19. Working Capital Working Capital refers to excess of Current assets over Current liabilities.

There are two types of working capital

- Gross working capital

- Net working capital

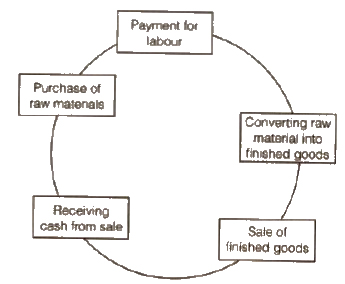

20. Operating Cycle

21. Factors Affecting the Working Capital

- Length of operating cycle

- Nature of business

- Scale of operation

- Business cycle fluctuation

- Seasonal factors

- Credit allowed

- Credit avail cycle

- Technology and production

- Operating efficiency

- Availability of raw materials

- Level of competition

- Inflation

- Growth prospects

Class 12 Key Points, Important Questions & Practice Papers

Hope these notes helped you in your schools exam preparation. Candidates can also check out the Key Points, Important Questions & Practice Papers for various Subjects for Class 12 in both Hindi and English language form the link below.

Class 12 NCERT Solutions

Candidates who are studying in Class 12 can also check Class 12 NCERT Solutions from here. This will help the candidates to know the solutions for all subjects covered in Class 12th. Candidates can click on the subject wise link to get the same. Class 12 Chapter-wise, detailed solutions to the questions of the NCERT textbooks are provided with the objective of helping students compare their answers with the sample answers.

Class 12 Mock Test / Practice

Mock test are the practice test or you can say the blue print of the main exam. Before appearing in the main examination, candidates must try mock test as it helps the students learn from their mistakes. With the help of Class 12 Mock Test / Practice, candidates can also get an idea about the pattern and marking scheme of that examination. For the sake of the candidates we are providing Class 12 Mock Test / Practice links below.

Class 12 Exemplar Questions

Exemplar Questions Class 12 is a very important resource for students preparing for the Examination. Here we have provided Exemplar Problems Solutions along with NCERT Exemplar Problems Class 12. Question from very important topics is covered by Exemplar Questions for Class 12.

Class 12 Business Studies Notes Maths Notes Economics Notes Sociology Notes

To get study material, exam alerts and news, join our Whatsapp Channel.